Quick Loans,

Easy Turnaround

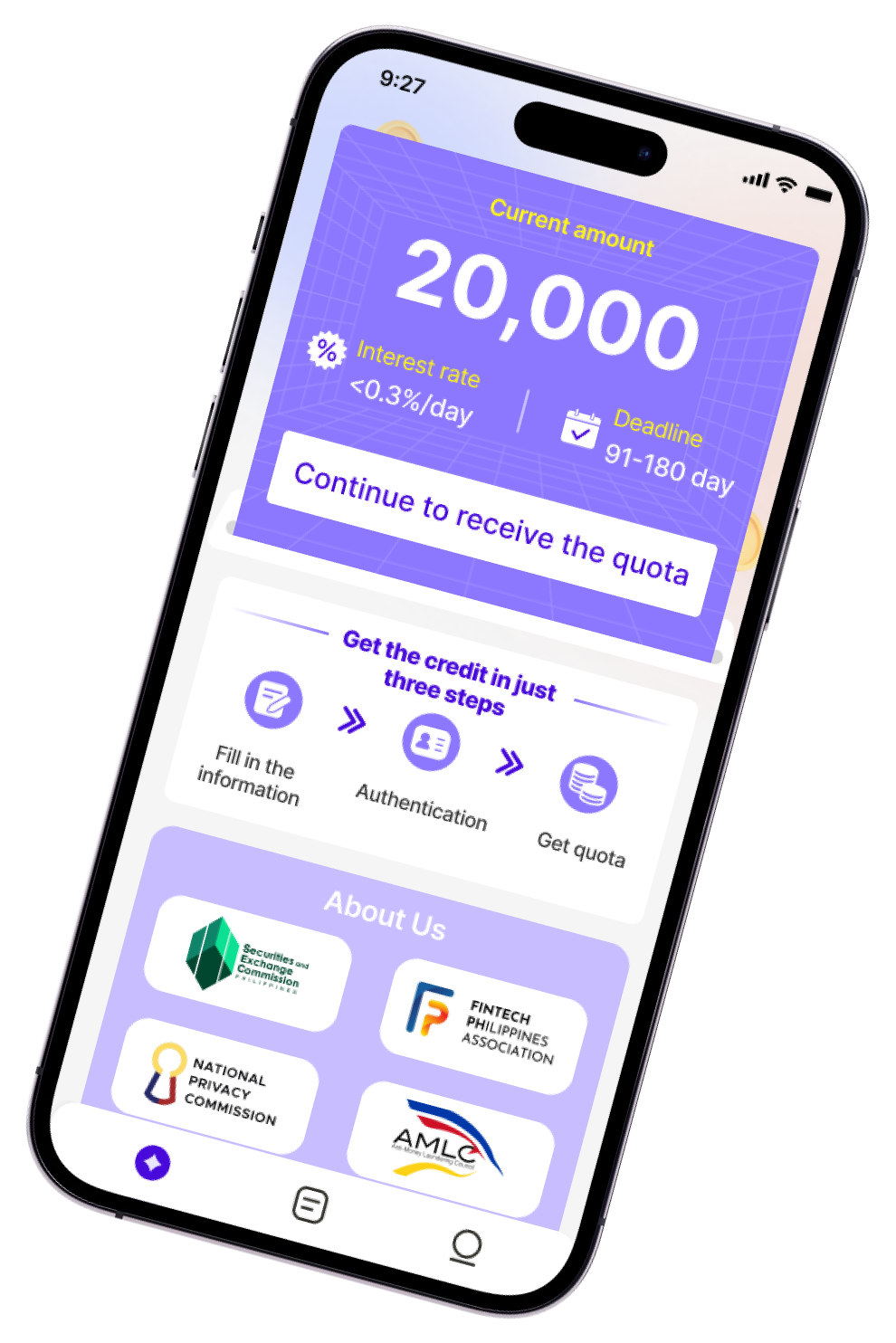

Borrow up to 50,000 pesos with a term of 91~180 days

Core Advantages

24-Hour Fast Disbursement

Fastest disbursement within 1 minute after approval, funds arrive in real-time

Fully Online Process

Complete the entire loan process via mobile without leaving home

No Collateral or Guarantor Needed

Pure credit loan-no collateral or guarantor required

Loan Process

Register & Verify

Download the app to register and complete identity verification

Submit Application

Fill in basic information and select loan amount term

Approval

Fast system review with real-time results

Funds Disbursed

Confirm loan amount, and funds arrive instantly

Product Features

Ultra-Low Interest

Daily interest rate as low as 0.03%, low repayment pressure

Flexible Credit Limits

Borrow up to 50,000 pesos as needed

Flexible Terms

Choose terms from 91~180 days for easier repayment

Q&A

What are the loan requirements?

Filipino citizens aged 21~60 with valid ID, stable job/business income, and good credit history can apply. No collateral or guarantor needed.

What are the loan amounts and terms?

First-time loans: 1,000~50,000 pesos with 91~180 day terms. Timely repayments increase limits up to 100,000 pesos.

How is interest calculated?

Interest is calculated daily, starting from 0.03%, based on your credit rating. All fees are disclosed upfront with no hidden charges.

How to repay?

Repay via bank transfer, GCash, 7~11 cash payments, etc. Get reminders and repay instantly in the app.

Download the App Now

Scan to download instantly